Insurance and EMI Guide : Buying your first car in today’s era is always a special moment and a day of joy. It is a feeling as if you feel that a dream of yours has come true and a wave of happiness sweeps over the house. But along with this happiness, there are also some responsibilities.

The two most important things are insurance and IMI, i.e. monthly installments. If they are not managed properly, the joy of owning a car turns into tension. But if you can easily manage both things with a little planning, then you can enjoy the benefits of your car for a long time.

WHY INSURANCE IS IMPORTANT?

Insurance is not just a formality but a safety measure. It protects both your car and your money. If your car gets into an accident or is stolen, insurance companies will help you. The best option is comprehensive insurance, that is, get full insurance for the car because it covers damage to your car as well as other vehicles. If the budget is very low, then you can get third-party insurance because it is cheaper, but it does not cover the damage to your own car. When buying insurance, do not just go for the lowest price, but see what facilities it has. Additional coverage such as engine protection, etc. should be available in it.

Understand EMI

EMI is another important aspect. Most people only look at the price of the car but do not think about how the EMI is affecting their monthly budget. One rule is that only 15 to 20 percent of your salary goes towards IMI. If it is more than this, it can have a bad impact on your daily expenses and budget. To reduce IMI, it is better to make a higher down payment in advance. For example, if the price of your car is Rs 1 million and you pay Rs 3 million in advance, the remaining loan will be Rs 8 million, which will last for a long time and will consume a lot of money from your budget every month. Now we see the opposite, if the price of the car is Rs 1 million and you pay 50 percent of it, that is, Rs 5 million, then you will be able to pay the remaining Rs 5 million easily over a period of time, and you will not have much burden and your monthly installment will also be reduced. And this is the wisdom. The shorter the term, the less the interest. It will go but the EMI will be higher.

Budget planning

For this reason, it is important that you plan your budget thoroughly before buying a car and consider whether you have any personal loans or credit card bills. After looking at all of these, decide whether the IMI and insurance premium can be paid easily or not when there is any pressure later. It is better to make a decision based on facts now than regret later.

Success and peace

Plan well so that you don’t have any problems later. Choose the right insurance, pay the appropriate advance and set the loan term according to your income. Then you can enjoy your first car without any financial worries. Buying a car is a big achievement and with proper planning, this joy can come into your life. You can enjoy your world without any tension and worries.

Conclusion

Before buying a car, it is important to look at your monthly budget carefully. If you already have personal loans or credit card bills, then you should not take this decision at all. In short, buying your first car is a big achievement. To maintain this happiness, it is important to choose the right insurance plan. Before making a decision, compare different options, make an appropriate down payment, and take a loan whose term can be easily adjusted according to your factors.

Read more: Insurance and EMI Guide for First Time Car Buyers: Understand Everything in Simple Language

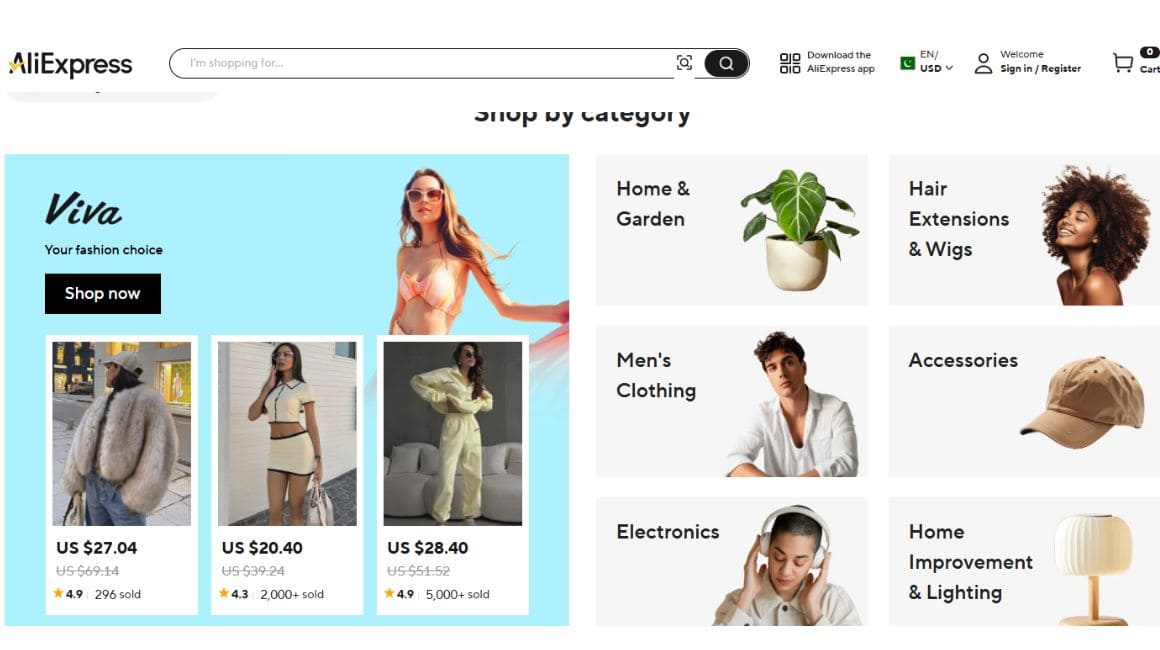

Maximize Profits: Best Affiliate Programs for Singles Day Sale 2025

September 13, 2025

Best Affiliate Programs for Singles Day Sale 2025 Singles Day Sale : or 11.11 sale was first popular in China and has now become a major shopping festival around the world. On this day, consumers get the lowest prices and great deals on electronics, home and kitchen, sports equipment, fashion, mobiles, laptops and many other things.

How to Earn Passive Income with Affiliate Marketing in 2025

September 13, 2025

What is Affiliate Marketing and how it works Earn Passive Income: Affiliate marketing is one of the most popular ways to make money online today. You promote a company’s products or services, and when someone makes a purchases through your special link, you get a commission. This way, the company gets a customer, and you get

Affiliate Marketing 2025: How to Earn Without a Website

September 13, 2025

Affiliate marketing 2025 has become a popular way to earn money online in this era. The best thing is that you don’t even need to have your own website for it. There are so many digital platforms and apps in 2025 that anyone can earn money from affiliate marketing with just hard work, creative thinking, and

Meesho Affiliate Program 2025: How to Register, Promote & Earn Online

September 13, 2025

Meesho Affiliate Program 2025: How to Register, You know that online shopping has grown rapidly in India and along with this, the opportunities to earn money from home have also increased. One of these opportunities is the Meeshu Affiliate Program, which is one of the easiest and most popular affiliate marketing platforms in 2025. Whether you

Understanding Sub-Affiliate Networks: How to Start & Earn Online

September 13, 2025

Understanding Sub-Affiliate Networks : Affiliate marketing is one of the most popular ways to grow your online business today. It allows brands to reach a larger audience and also provides bloggers, YouTubers, and influencers with a new way to earn money by promoting products. Sub-Affiliate Networks Affiliate networks play a very important role in this

Affordable 125cc Bikes in India: Top 5 Under ₹1.5 Lakh

September 12, 2025

Affordable 125cc Bikes in India : If Are you looking to buy a 125cc bike that is stylish, fuel efficient and performs well . Then you are at the right place. Several bike brands in India offer great models in the 125cc segment that are both budget-friendly and feature-packed. These bikes are perfect for daily commutes,

Affordable Cars Under ₹7 Lakh That Don’t Compromise on Safety

September 12, 2025

Affordable Cars Under ₹7 Lakh : The most important thing while buying a car is safety . Earlier people mostly gave importance to mileage and design, but now the safety of the family has become the top priority. If your budget is up to Rs 7 lakh and you want your car to have style, mileage

Best Sedan Cars in India 2025: Stylish, Comfortable & Affordable Options

September 12, 2025

Best Sedan Cars in India : Sedan cars have always had a reputation in India and have always attracted people. Stylish design, comfortable seats and spacious interiors make them special. In 2025, buyers are looking for cars that are not only easy on the pocket but are also great for long journeys and daily use. If

Insurance and EMI Guide for First Time Car Buyers: Understand Everything in Simple Language

September 12, 2025

Insurance and EMI Guide : Buying your first car in today’s era is always a special moment and a day of joy. It is a feeling as if you feel that a dream of yours has come true and a wave of happiness sweeps over the house. But along with this happiness, there are also some

MUST READ

- How to Find Trending Blog Topics in 2025 (10 Easy Guide):

- Motorola Moto G Play 2026: Everything You Need to Know

- Best Antivirus Affiliate Programs 2026: 13 Global Opportunities

- Ultimate List: Best Pet Affiliate Programs 2025 with Data & Insights

- Complete List: 10 Best Crypto Affiliate Programs & Offers in 2025

- AliExpress Affiliate Program: Proven Easy Steps to Make Money

Leave a Comment