Indian Bloggers & Affiliate : If you are a blogger, run a YouTube channel, or do affiliate marketing and live in India — then this article is very important for you.

Let’s understand in simple and common sense language:

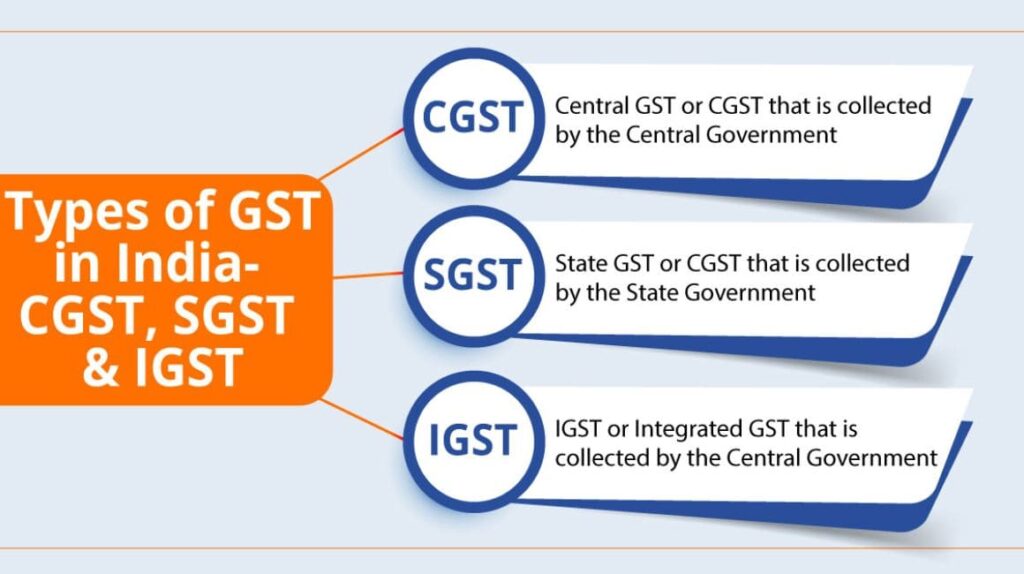

What is GST?

GST stands for Goods and Services Tax .

It’s a tax you pay to the government when you sell something — like:

- Services (e.g. Sponsored Posts, Promotions)

- Earnings (Affiliate Links, AdSense, etc.)

Understand: If you are earning online, you are providing a “service.”

Are bloggers, YouTubers, and affiliates also subject to GST?

Yes, if:

- Your annual income is ₹20 lakh or more (₹10 lakh in some states)

- So you must do GST registration.

What if the income is less than 2 million?

So then:

- You don’t need to charge GST.

- Just filing Income Tax (ITR) is enough.

- You can earn comfortably.

But if you want to work with big brands or companies, they often only work with people with GST .

What if you receive money from outside India?

For example:

- Your client is in the US, UK or Dubai.

- Your earnings come through PayPal or Wise.

So this is called: Export of Services.

In such a case:

- You will have to register for GST.

- But you will file “LUT”

- Which will make your GST 0% , meaning you will not have to pay tax.

Easy way to register for GST (Step-by-Step)

- Go to GST Portal:

Go to the website: https://www.gst.gov.in - Create a new account:

Click “Register Now” and enter your basic information like PAN card, mobile number, and email. - OTP Verification:

Enter the OTP received on your mobile and email to verify your identity. - Start filling out the form:

Provide your business details, address, and bank information. - Upload documents:

Upload PAN card, identity document, address proof, and bank account details. - Submit Application:

Submit the application after checking all the information. - Get GSTIN:

You will get your GST number usually in 3-7 days.

What is LUT?

LUT = Letter of Undertaking

This is a way of telling the government that:

“I am providing services in a foreign country, so GST is not applicable to me.”

The benefit?

- You don’t have to pay taxes.

- The form only needs to be filled out once a year or month.

How much GST do I have to pay?

If you are providing services to a company or individual in India:

- So 18% GST will have to be paid.

For example, if you wrote a Sponsored Post worth ₹10,000, you may have to pay ₹1800 in tax.

What are the benefits of GST registration?

You work legally,

companies trust you,

big brands hire you,

there is no problem with income tax,

it is necessary for long-term work.

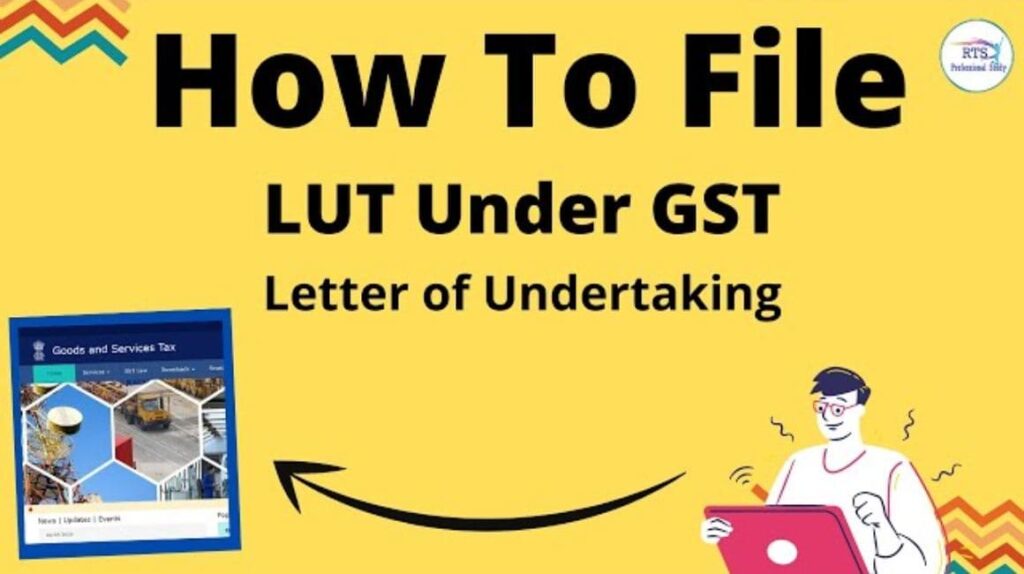

Easy way to file LUT (Letter of Undertaking)

- Login to GST portal: Open

your GST account at https://www.gst.gov.in/ . - Find the LUT form:

Go to “Services” → “User Services” → “Furnish Letter of Undertaking (LUT)”. - Fill the form:

Enter your company or individual details, PAN, and GSTIN in the form. - Sign and submit:

Sign the form (digital signature or e-signature) and submit it. - LUT Approval:

You usually get LUT approval within a few days. - Start operating at zero percent GST:

You can now operate at 0% GST by providing services to international clients.

When should the return be filed?

If you are GST registered:

- Returns have to be filed every month or every three months (quarterly).

- Whether you have earned it or not

The last thing: what should be done?

If you are just doing amateur blogging or making videos and your earnings are low, don’t worry.

But if:

- Your earnings are increasing.

- You are getting money from outside or from big companies.

- Or do you plan to turn blogging into a business?

So, register for GST wisely from now on , and definitely take advice from a good CA (accountant) .

Leave a Comment